Riskfolio-Lib

Quantitative Strategic Asset Allocation, Easy for Everyone.

Description

Riskfolio-Lib is a library for making quantitative strategic asset allocation or portfolio optimization in Python made in Peru

Some of key functionalities that Riskfolio-Lib offers:

-

Mean Risk and Logarithmic Mean Risk (Kelly Criterion) Portfolio Optimization with 4 objective functions:

- Minimum Risk.

- Maximum Return.

- Maximum Utility Function.

- Maximum Risk Adjusted Return Ratio.

-

Mean Risk and Logarithmic Mean Risk (Kelly Criterion) Portfolio Optimization with 13 convex risk measures:

- Standard Deviation.

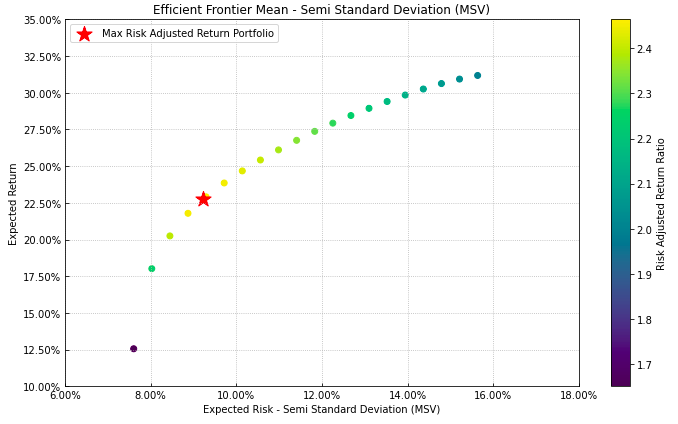

- Semi Standard Deviation.

- Mean Absolute Deviation (MAD).

- First Lower Partial Moment (Omega Ratio).

- Second Lower Partial Moment (Sortino Ratio).

- Conditional Value at Risk (CVaR).

- Entropic Value at Risk (EVaR).

- Worst Case Realization (Minimax Model).

- Maximum Drawdown (Calmar Ratio) for uncompounded cumulative returns.

- Average Drawdown for uncompounded cumulative returns.

- Conditional Drawdown at Risk (CDaR) for uncompounded cumulative returns.

- Entropic Drawdown at Risk (EDaR) for uncompounded cumulative returns.

- Ulcer Index for uncompounded cumulative returns.

-

Risk Parity Portfolio Optimization with 10 convex risk measures:

- Standard Deviation.

- Semi Standard Deviation.

- Mean Absolute Deviation (MAD).

- First Lower Partial Moment (Omega Ratio).

- Second Lower Partial Moment (Sortino Ratio).

- Conditional Value at Risk (CVaR).

- Entropic Value at Risk (EVaR).

- Conditional Drawdown at Risk (CDaR) for uncompounded cumulative returns.

- Entropic Drawdown at Risk (EDaR) for uncompounded cumulative returns.

- Ulcer Index for uncompounded cumulative returns.

-

Hierarchical Clustering Portfolio Optimization: Hierarchical Risk Parity (HRP) and Hierarchical Equal Risk Contribution (HERC) with 22 risk measures:

- Standard Deviation.

- Variance.

- Semi Standard Deviation.

- Mean Absolute Deviation (MAD).

- First Lower Partial Moment (Omega Ratio).

- Second Lower Partial Moment (Sortino Ratio).

- Value at Risk (VaR).

- Conditional Value at Risk (CVaR).

- Entropic Value at Risk (EVaR).

- Worst Case Realization (Minimax Model).

- Maximum Drawdown (Calmar Ratio) for compounded and uncompounded cumulative returns.

- Average Drawdown for compounded and uncompounded cumulative returns.

- Drawdown at Risk (DaR) for compounded and uncompounded cumulative returns.

- Conditional Drawdown at Risk (CDaR) for compounded and uncompounded cumulative returns.

- Entropic Drawdown at Risk (EDaR) for compounded and uncompounded cumulative returns.

- Ulcer Index for compounded and uncompounded cumulative returns.

-

Nested Clustered Optimization (NCO) with four objective functions and the available risk measures to each objective:

- Minimum Risk.

- Maximum Return.

- Maximum Utility Function.

- Equal Risk Contribution.

-

Worst Case Mean Variance Portfolio Optimization.

-

Relaxed Risk Parity Portfolio Optimization.

-

Portfolio optimization with Black Litterman model.

-

Portfolio optimization with Risk Factors model.

-

Portfolio optimization with Black Litterman Bayesian model.

-

Portfolio optimization with Augmented Black Litterman model.

-

Portfolio optimization with constraints on tracking error and turnover.

-

Portfolio optimization with short positions and leveraged portfolios.

-

Portfolio optimization with constraints on number of assets and number of effective assets.

-

Tools to build efficient frontier for 13 risk measures.

-

Tools to build linear constraints on assets, asset classes and risk factors.

-

Tools to build views on assets and asset classes.

-

Tools to build views on risk factors.

-

Tools to calculate risk measures.

-

Tools to calculate risk contributions per asset.

-

Tools to calculate uncertainty sets for mean vector and covariance matrix.

-

Tools to calculate assets clusters based on codependence metrics.

-

Tools to estimate loadings matrix (Stepwise Regression and Principal Components Regression).

-

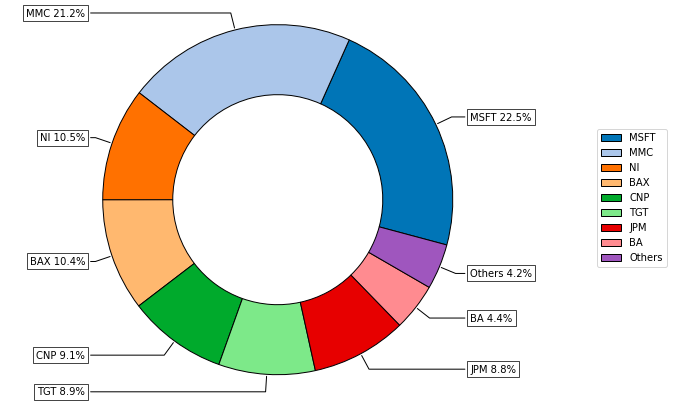

Tools to visualizing portfolio properties and risk measures.

-

Tools to build reports on Jupyter Notebook and Excel.

-

Option to use commercial optimization solver like MOSEK or GUROBI for large scale problems.

Documentation

Online documentation is available at Documentation.

The docs include a tutorial with examples that shows the capacities of Riskfolio-Lib.

Dependencies

Riskfolio-Lib supports Python 3.7+.

Installation requires:

- numpy >= 1.17.0

- scipy >= 1.1.0

- pandas >= 1.0.0

- matplotlib >= 3.3.0

- cvxpy >= 1.0.15

- scikit-learn >= 0.22.0

- statsmodels >= 0.10.1

- arch >= 4.15

- xlsxwriter >= 1.3.7

- networkx >= 2.5.1

- astropy >= 4.3.1

Installation

The latest stable release (and older versions) can be installed from PyPI:

pip install riskfolio-lib

Citing

If you use Riskfolio-Lib for published work, please use the following BibTeX entrie:

@misc{riskfolio,

author = {Dany Cajas},

title = {Riskfolio-Lib (2.0.0)},

year = {2021},

url = {https://github.com/dcajasn/Riskfolio-Lib},

}

Development

Riskfolio-Lib development takes place on Github: https://github.com/dcajasn/Riskfolio-Lib

RoadMap

The plan for this module is to add more functions that will be very useful to asset managers.

- Add more functions based on suggestion of users.